A drop in first-time jobless claims calmed nerves about the economy.

“In 2008 it felt apocalyptic; this just feels a little tiring,” said Jason Weisberg, a floor trader on the New York Stock Exchange and senior vice president at Seaport Securities

“It’s the new norm,” Alan Valdes, director of floor trade at DME Securities, said of the ongoing volatility.

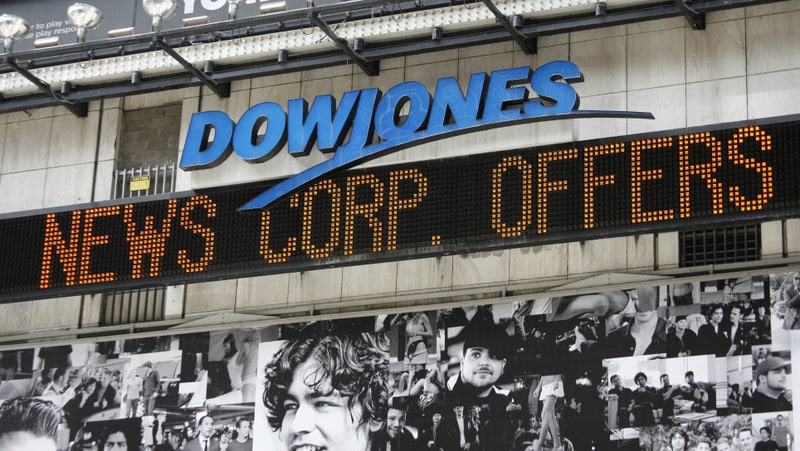

After rising as much as 558.96 points, the Dow Jones Industrial Average ended up 423.37 points to 11,143.31, or 4% higher. The blue-chip index is now off 2.6% for the week, after four days of closing up or down 400 points or more.

For every stock that fell, a dozen gained on the New York Stock Exchange, where nearly 1.9 billion shares traded. Composite volume neared 7 billion.

“While the economy may not be getting better, jobless claims indicate that the labor market may not be getting worse,” said Dan Greenhaus, chief global strategist at BTIG LLC.

The Dow industrials on Monday tanked 634 points, only to rebound with a 429-point gain Tuesday. On Wednesday, the average fell 519 points in triple-digit moves reminiscent of Wall Street’s behavior during the financial crisis of late 2008.

“In 2008, the problem was a massive overhang of poorly understood, faulty mortgage-backed securities created and insured by U.S. financial institutions with virtually no reliable collateral,” noted Peter Morici, a business professor at the University of Maryland. “This time, the principal debtors are sovereigns with the capacity to tax and restructure debt.”

No comments:

Post a Comment